As a small business owner, what do you need to know and what are your options? The Affordable Care Act will provide small business owners the opportunity to offer quality health insurance to their employees at affordable prices. Small business owners were limited by choices, higher premiums, and other restrictions when providing health insurance for their employees. One benefit is that insurance companies will not be able to charge higher premiums for chronic or pre-existing conditions, gender, or age. Small groups will be pooled together to mitigate risk similar to large corporations. All plans must offer “Essential Health Benefits” and cannot have an annual dollar limit on coverage.

Employer Requirements

The first requirement for employers covered by the Fair Labor Standards Act is to provide all employees with a letter about the Health Insurance Marketplace, eligibility requirements for the premium tax credit and loss of employer contribution if they purchase insurance through the Individual Marketplace. This was due by Oct. 1, but there are no penalties or fines if you haven’t done it yet. If you still need to provide this letter but don’t know what to include, there are samples available through the Small Business Administration (SBA) for your use.

Health Insurance Options

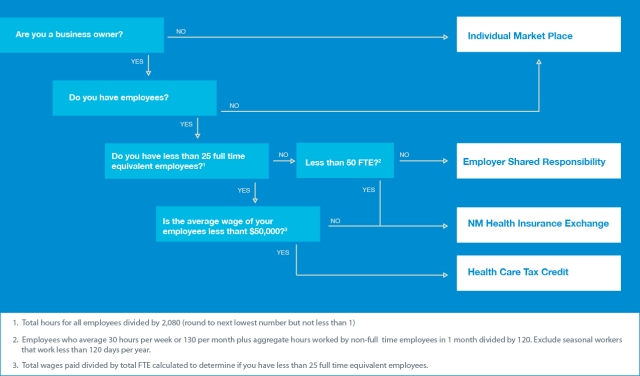

Now, the next step is figuring out where you land in the Affordable Care Act web and what options are available to you. Use the flow chart to help you figure it out.

Individual Marketplace

Starting in 2014, all individuals (including self-employed business owners) will be required to have basic health insurance coverage also known as minimum essential coverage. The different types of coverage that will qualify are employer provided health insurance, Medicare Part A, Medicaid, Children’s Health Insurance Program, Veterans health coverage, and TRICARE. If you do not have coverage from one of these options, then you can get health insurance from the new individual market health insurance marketplace. You will be liable for the shared responsibility tax if you do not have health insurance and don’t qualify for an exemption. The good news is that open enrollment for the individual marketplace has begun with coverage starting Jan. 1, 2014. There will be four levels of coverage based on premium costs and out-of pocket expenses. Some individuals will qualify for a tax credit and subsidies based on income. When considering a health care plan be sure to look at the premium cost, out-of-pocket expenses and the deductible.

Health Care Tax Credit

A small business may qualify for the Small Business Healthcare Tax Credit if it employs fewer than 25 full-time equivalent employees with average annual wages below $50,000. The business will need to contribute 50 percent or more towards the employee’s premium costs. In 2014, the tax credit will be up to 50 percent for employers who participate in Small Business Health Options Program (SHOP). The SBA has a tax credit estimator that you can see if you are eligible and how much you might receive. Also read the paragraph below to learn more about SHOP and New Mexico Health Insurance Exchange.

NM Health Insurance Exchange

If you are a small business with up to 50 full-time equivalent employees, you will be able to purchase health insurance through Small Business Health Options Program (SHOP). New Mexico SHOP is provided by New Mexico Health Insurance Exchange (NMHIX). Now small businesses will be able to offer affordable health insurance to their employees based on quality and coverage options. NMHIX is offering free seminars to small business owners to learn about the different features and plans available to your business. NMHIX will let you compare plans based on quality, price, benefits and features. The insurance company choices will include Blue Cross Blue Shield, Lovelace, New Mexico Health Connections, and Presbyterian. There will be four categories of plans based on premium costs and out-of-pocket cost limits. There is an online evaluation tool to help you determine the best coverage options. You can begin enrollment now with coverage beginning Jan. 1, 2014. So attend the seminar coming up on Nov. 7 to learn more about NMHIX and your different options. Register at www.losalamoschamber.com

Employer Shared Responsibility

Employers with more than 50 full-time equivalent employees that do not offer affordable health insurance to their full-time employees will be assessed a penalty starting in 2015. The Employer Shared Responsibility penalty will be assessed if an employer does not offer coverage to at least 95% of its full-time employees or the coverage is not affordable or doesn’t provide minimum value and at least one full-time employee receives a premium tax credit in the individual health insurance marketplace. Minimum value is when the plan covers at least 60% of the total cost of benefits. Coverage will be considered affordable if the employee’s cost is not more than 9.5% of annual household income or W-2 wages. The penalty assessed will depend on the violation of the employer. There will be no penalty for non-coverage of part-time employees, if the employee declines the affordable coverage, or if the employee obtains coverage through a spouse or other means except the individual marketplace. Coverage will need to be offered to all full-time employees and their dependents under the age of 26.

As you can see, the affordable care act can be confusing but luckily there are resources available to assist you as a small business owner. Los Alamos Business Assistance Services has a business advisor who is happy to sit down with you and figure out the impact to your business. You can contact Katie Stavert at 505.661.4805 or katie@losalamos.org.

There are online resources available at www.sba.gov/healthcare, www.bewellnm.com, and www.healthcare.gov.