Los Alamos County Council voted 5-2 this evening to tentatively approve the County Assessor’s Office proposed budget of $608,682 for FY2017. Councilors from left, Kristin Henderson, Steven Girrens, Vice Chair Susan O’Leary, Chair Rick Reiss and councilors David Izraelevitz, Pete Sheehey and James Chrobocinski. Photo by Carol A. Clark/ladailypost.com

Los Alamos County Council voted 5-2 this evening to tentatively approve the County Assessor’s Office proposed budget of $608,682 for FY2017. Councilors from left, Kristin Henderson, Steven Girrens, Vice Chair Susan O’Leary, Chair Rick Reiss and councilors David Izraelevitz, Pete Sheehey and James Chrobocinski. Photo by Carol A. Clark/ladailypost.com

Los Aamos County Assessor Ken Milder, left, and Chief Deputy Assessor Joaquin Valdez brief the County Council on the Assessor’s Office Budget during this evening’s second night of budget hearings. Photo by Carol A. Clark/ladailypost.com

Los Aamos County Assessor Ken Milder, left, and Chief Deputy Assessor Joaquin Valdez brief the County Council on the Assessor’s Office Budget during this evening’s second night of budget hearings. Photo by Carol A. Clark/ladailypost.com

Staff Report

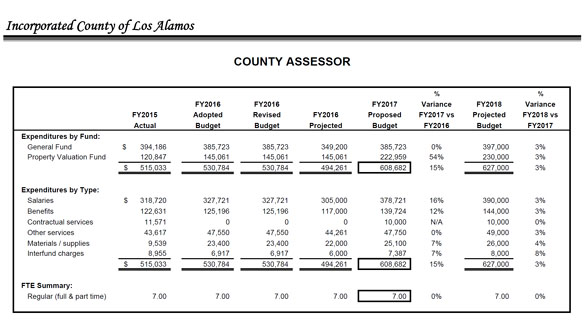

Council voted 5-2 this evening to tentatively approve the proposed budget of $608,682 for the County Assessor’s Office for FY2017. Council Vice Chair Susan O’Leary and Councilor David Izraelevitz voted against the measure, asking instead that the issue be placed in the ‘parking lot’ for further review because the department asked for a 15 percent increase. The issue of employee certifications also came up in discussion prior to the vote. County Assessor Ken Milder has been directed to return to council with more detailed information by Monday.

Assessor’s Office Budget Overview:

The FY2017 Proposed Budget will assure the functions and the responsibilities of the County Assessor are met in accordance with the Property Tax Code. This budget will provide the resources needed to complete the objectives stated in the Property Valuation and Maintenance plan. Field inspections will be conducted. All new construction shall be inspected and valued accordingly. Deed transfers and survey plats will be recorded accordingly. Employees will receive their continuing education requirements for their NM Certified Appraiser Certificate. All sales will be verified and a sales ratio study will be performed to assure assessments are within statistical standards. Properties will be valued in a uniform manner, providing fair and equitable assessments.

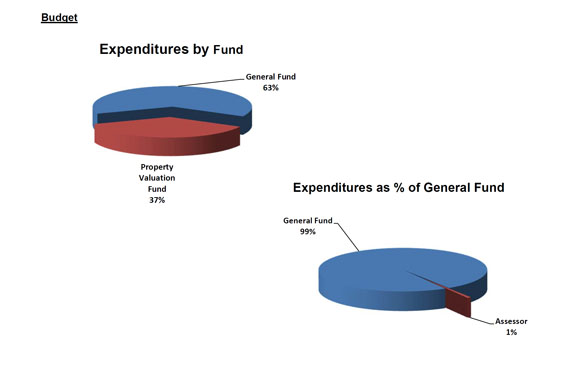

The County Assessor is responsible for assuring that all statutory requirements of the New Mexico Property Tax Code (PTC) regarding property valuation are met. The PTC requires that counties fund the County Assessor’s Office from the General Fund except for certain expenditures that are permitted from the Property Valuation Fund (PVF). Expenditures from the Property Valuation Fund are for the sole purpose of conducting a reappraisal program. Under that program, one-fifth (1/5) of real property within the county is reappraised each year on a rotating basis.

For the remaining four-fifths (4/5) of real property, valuation maintenance models are used to estimate current value and the associated costs for this process are allocated from the General Fund. Costs to appraise new or renovated construction as well as costs associated with appraisal training and certification may also be allocated from the PVF.

Revenue for the PVF comes from 1 percent admin fee assessed on all property tax revenue collected by the County on behalf of all taxing entities. In Los Alamos County, those entities include the Los Alamos Public Schools, UNM-LA, the State of New Mexico, and the County (and municipality) of Los Alamos.

During budget preparation $12,037 was moved from the General Fund to the Property Valuation Fund to keep the General Fund Budget flat. Based on the purposes of the allocated amounts, the Assessor has determined and believes that the amounts are more appropriately allocable to the General Fund.

Every year the County Assessor’s Office is audited by the New Mexico Property Tax Division. Los Alamos County has consistently been commended for its operations, efficiency, and compliance with the NM Property Tax Code. FY2015 was no exception. Only one finding, that an annual Notice of Valuation (NOV) must also be mailed to all tax exempt property owners, and one suggestion, to review all non-governmental tax exempt entities for continued eligibility, were entered into the audit report. The costs associated with preparing, printing, and mailing the additional 610 NOVs to exempt property owners is borne by the General Fund. (Only 7 of the exempt properties are non-governmental.)

Courtesy/LAC

Courtesy/LAC

Courtesy/LAC

Courtesy/LAC