By GEORGE CHANDLER

By GEORGE CHANDLER

Los Alamos County Assessor

Aarrg! Let me start with the most abject apology I can muster from the depths of a chastened heart. I inadvertently sent for publication an early version of this document in which changes to calculations had not been properly saved. I do apologize to you, and to Carol and the Daily Post for sullying their pages. Please believe that the professional appraisers in the Assessor’s office are a lot more careful with your tax dollars than I was with this column.

Los Alamos property owners by now will have received their 2023 Notices of Valuation (NOV) from the Office of the Los Alamos County Assessor. Most will see relatively little change in their taxable value from last year, but for some there may be a big surprise.

Imagine yourself in a home you recently purchased. You settle in and maybe even do some fix-up to make it “your own.” Now fast forward to April 1st of the following year when you receive your NOV which now reflects an estimated increase in taxable value of 50%, 60%, 70% or more. HOW CAN THIS HAPPEN?! Well, you just got hit by the unintended consequences of a well-intentioned state law. The consequence is called “tax lightning.”

Years ago, as more people moved into New Mexico, many older residential neighborhoods were becoming gentrified, which caused property values to increase. Lower income property owners, some of whom owned property that had been in their family for generations, were being taxed out of their homes. To remedy this situation, the state legislature passed a law limiting yearly residential assessment increases to 3%, regardless of changes in the property’s actual market value.

The law capping annual assessment increases has several exclusions, among them are increases in the market value of the home due to improvements and additions. (Non-residential property, such as commercial or vacant land regardless of zoning, is also excluded from the cap). The exclusion that hits home purchasers the hardest, however, is home ownership transfers. With certain limited exceptions, when ownership of a home transfers to a new owner the assessment is set to the market value as determined by the Assessor’s Office on January 1 of the following year. This should not be a surprise because realtors are required to provide the buyer with the Assessor’s estimate of the taxes on the home before the sale, but some people may miss it in the flurry of paperwork involved in closing a sale. Hence the term, “tax lightning.” Let’s put some numbers to this.

Starting in 2007, the market value of Los Alamos homes fell. Although assessment increases are capped by the statute, assessment decreases have no limit. In late 2015, the housing market turned upward, and sales prices have increased every year at current double-digit rates. As a result, approximately 90% of residential assessments in Los Alamos are capped. Those homeowners do not see a dramatic increase in their property assessment. Tax lightning only affects the purchaser of residential property.

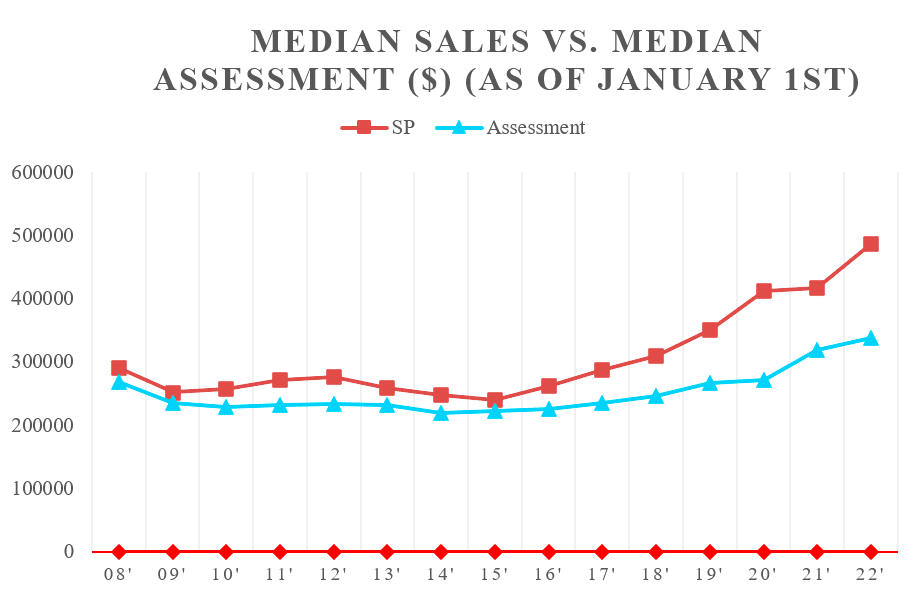

The following graph illustrates the impact of tax lightning. Looking at median residential sale prices and median residential assessment values on January 1 of each year from 2008 through 2022, the graph shows the disparity between the two values. The widening gap is the effect of the cap – in most years our uncapped assessments are within a few percent of the market.

From 2006 through 2022, the disparity between median sales price and median assessment value ranged from 7 % to 52%. What does this mean in real dollars to the taxpayer who purchased a home? Let’s say for example, you purchased a home in 2022at the median sales price of $350,000. Your estimated tax bill at closing would have been based on the previous owner’s assessment of $265,585. The estimated taxes would have been approximately $2,200.

On Jan. 1, 2023, your assessment would adjust to market value, $486,500 assuming the Assessor’s market value estimate is close to the sales price. The November 2023 tax bill would be approximately $3,370, a 53% increase!

If you’re not persuaded by this or for any other reason believe your property is incorrectly valued for taxation purposes, you have a number of formal and informal ways to seek redress. Easiest and potentially the quickest is to call our office at 505.662.8030 and tell Bella you have a problem with your property valuation. She will discuss it with you, or hand you off to another appraiser to see if there’s a quick resolution to your issue available in our vast (no kidding!) database. You can drop into the office, suite 210 at 1000 Central Ave. for a more extensive discussion, and bring with you any documentation you may have supporting your position. If we can’t resolve your problem or if you don’t want to try the easy way just described, you can file a formal protest within 30 days of the date we mailed you the Notice of Value – this year we expect to mail it on March 31.

The formal protest provides another opportunity for an informal settlement discussion before it goes to a hearing before a three-person board. Our office can provide you the protest form partially filled out to save you some digging, or you can reach a fillable protest form on our website at: https://www.losalamosnm.us/government/elected_officials/assessor then activate the “file a protest” button in the list at the left for instructions and a link to the form. A second avenue of protest involves filing a civil action for a refund in District Court after you have paid the taxes, we can provide you with more information on that in the office or on our website.

This column was plagiarized and updated from columns published previously by my predecessor Ken Milder, to whom I am indebted for leaving the Assessor post in outstanding condition, with a great staff, and with pre-formatted reports. I hope this helps you understand this peculiarity of our property tax system, and how you can seek redress. I’m available to discuss this with you; and the experts in our office – 1000 Central, suite 210 – can provide you with valuation data and protest information on your property. Visit our website at https://www.losalamosnm.us/government/elected_officials/assessor.