By SANDY NELSON

Finance New Mexico

The deadly November wildfires in California, which killed at least 88 people and wiped an entire town from the map, demonstrate how suddenly and shockingly disaster can strike and how long it can take for individuals to rebuild their lives and livelihoods—including in New Mexico, where wildfire is an ever-present risk.

While individuals often take time to process their loss and rebuild their lives, business owners must react quickly to salvage customers and retain employees.

Rapid recovery is the only way to minimize damage to profitability and to the customers and employees who depend on small businesses.

A business impact analysis (BIA) can give a small business more resilience at such times and help its stakeholders bounce back from catastrophic damage caused by unpredictable events or natural forces.

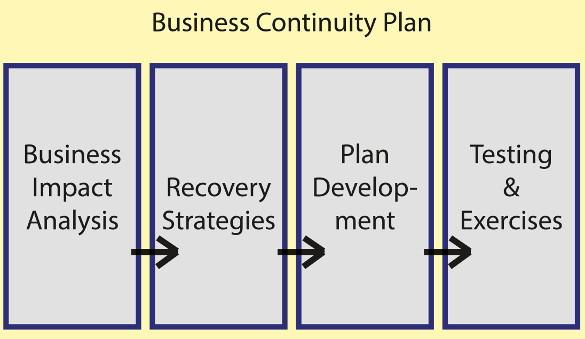

A BIA is the first step in a larger business continuity plan. Once the BIA is drafted, business principals then compare existing resources with what they’ll need to survive and recover. They develop a strategy based on that gap analysis and test it the same way first responders do—with mock exercises—and refine the plan based on what these rehearsals teach.

But every continuity plan starts with a detailed, unfiltered look at business functions. In a BIA, the business owner should:

- Survey managers and employees who have detailed knowledge about how the business provides its products or services; it should ask them about the likely consequences if those processes suddenly stopped—and what the legal and financial fallout would be if the interruption lasted a week or a month or longer. The survey or questionnaire should ask the people who perform and supervise the work what specific resources the business would need to continue some level of operations after a disaster.

- Review employee suggestions and evaluate which are essential and which can be postponed for a later stage. Customer care representatives might insist that retaining loyal customers requires communicating with them through a blog or Facebook postings about when the business will reopen. A machine operator might contend that getting production restarted is vital to raising revenue to pay employees and vendors. Business owners should gather all this feedback to help them develop the larger continuity plan.

- Develop a report based on employee feedback. The report should describe all the potential impacts identified by employees and managers and be the foundation for a plan that rebuilds the business step by step, beginning with functions that get the company back into the business of serving customer needs, making payroll and returning to profitability.

It’s natural for a business owner to resist taking a hard look at the many things that could destroy what he or she has worked so hard to build and nurture. But it’s unrealistic to assume that insurance will cover every potential loss. By involving employees, the business owner can get a more objective and less emotional appraisal of where things stand so the entire company can arm itself for whatever life brings.

For a detailed description of BIAs and how they fit into a business continuity plan, click here.

Finance New Mexico connects individuals and businesses with skills and funding resources for their business or idea. To learn more, go to www.FinanceNewMexico.org.